How to structure a women’s health startup before raising capital

Investors talk about inclusive startups, but what are they really looking at? Not the fine words, but the concrete, pre-raised structuring of a women’s health startup. Over the past three years, we have analyzed 40+ fund-raising files. Our findings are clear: successful female founders are not marketing feminism. They build inclusivity right from the code, patient architecture and governance. And that shows in the investor pitch.

In this article, we look at five concrete players who have structured inclusivity as a structuring variable, long before they were looking for capital. Eva Ngallé (TI3RS), Hélène Antier and Chloé Bonnet (Lyv.Endo), Emeline Hahn (Fizimed), and catalysts Delphine Moulu (Femtech France) and Iris Maréchal (Theremia) trace different but converging paths.

At the end, you’ll have a pre-raised framework audit to diagnose whether your women’s health startup is really ready and where investors are really looking.

Sourcing disclaimer

The cases and information presented below are based on public data (LinkedIn profiles, press articles, official websites). For precise confirmation of specific metrics or milestones, we recommend consulting the founders and teams mentioned directly.

Why investors scrutinize inclusivity pre-emptively

Investors don’t value inclusiveness out of idealism. It is above all a variable for reducing operational and regulatory risk. Three concrete levers explain this.

First lever: user adoption.

When a solution is co-designed directly with target users, rather than built in a silo and then validated afterwards, engagement naturally accelerates. Users involved from the outset become ambassadors for the product. Investors calculate: organic adoption means likely scalability.

Second lever: regulatory compliance.

Since 2023, theANSM (Agence Nationale de Sécurité du Médicament) and the HAS (Haute Autorité de Santé) have been systematically asking the question: “Have you tested in mixed populations? Do you have gender-stratified results?” Startups that answer “yes, with documented proof” move forward faster. Access to French reimbursement is critical for healthcare start-ups. Investors see: tested inclusivity means de-risked compliance.

Third lever: public funding.

BPI France, Horizon Europe and ANR promote innovations that integrate inclusivity. For women’s health startups, this creates access to dedicated public capital. Investors see: public capital means reduced equity dilution for founders.

Aggregate signal for investors: If a founder thought inclusivity from day zero, she thought adoption, compliance, and capital strategy. This changes the entire risk profile of the case.

Case 1 – Eva Ngallé and TI3RS: a confidential support platform

TI3RS is a digital support platform for women victims of violence, focusing on confidentiality and digital solutions.

Structuring issues before lifting (according to our audit) :

- Clarify value proposition (confidentiality vs. support vs. network?)

- Validate field impact with measured user KPIs

- Secure RGPD governance and compliance (external audit)

- Document co-creation with associations (signal co-responsibility)

- First user KPIs established

The key signal for investors: a founder who listens directly to users before coding demonstrates a deep understanding of the market.

For more information: TI3RS

Case 2 – Hélène Antier, Chloé Bonnet and Lyv.Endo: endometriosis patient application

Lyv.Endo supports endometriosis sufferers via a mobile application designed by and for patients. The app offers follow-up, guidance and links to practitioners.

Structuring issues before lifting (according to our audit) :

- Operational and polished product demo

- Setting up a clinical pilot with hospital(s)

- Defined medical validation protocols

- Systematic collection of patient AND practitioner feedback

- Preparation of regulatory dossier (ANSM/HAS roadmap)

The key signal for investors: a mixed founding team (clinician + UX/tech) signals a product that has been thought through on two dimensions simultaneously.

For more information: Lyv.Endo app

Case 3 – Emeline Hahn and Fizimed: connected device for perineal rehabilitation

Fizimed offers a connected device for perineal rehabilitation, combined with a mobile application and structured medical prescription. Status: growth/scale-up.

Structuring issues before lifting (according to our audit) :

- Structuring of industrial roadmap (clear product schedule)

- Reimbursement validation (HAS, medical CE marking)

- Clinical evidence documentation (studies, publications)

- Quantified economic AND medical impact

- EU market expansion planned

The key signal for investors: a founder who validates her clinical and regulatory credentials before pitching demonstrates rigor and understanding of the healthcare sector.

More: Fizimed connected device

Ecosystem catalysts – Delphine Moulu and Iris Maréchal

Two players structure the wider ecosystem.

Delphine Moulu (Femtech France). Community development, networking, innovation via Station F, event organization. Status: established associative structure.

Structuring issues (according to our audit) :

- Formalizing network value (mentoring, workshops, visibility)

- Solid associative governance structure

- Documentation and membership

- Synergy with thematic funds (BPI, impact, etc.)

For more information: Femtech France & Femmes de Santé

Iris Maréchal (Theremia CEO). AI reproductive health, predictive algorithms for improved patient care. Status: innovation pilot phase.

Structuring issues (according to our audit) :

- Field study documentation (validation required)

- Scientific validation (publications, peers)

- IA medical regulatory framework clarified

- Identifying hospital and clinic partners

- Impact AND revenue roadmap defined

The key signal for investors: actresses who structure the ecosystem demonstrate a systemic vision, not just a product.

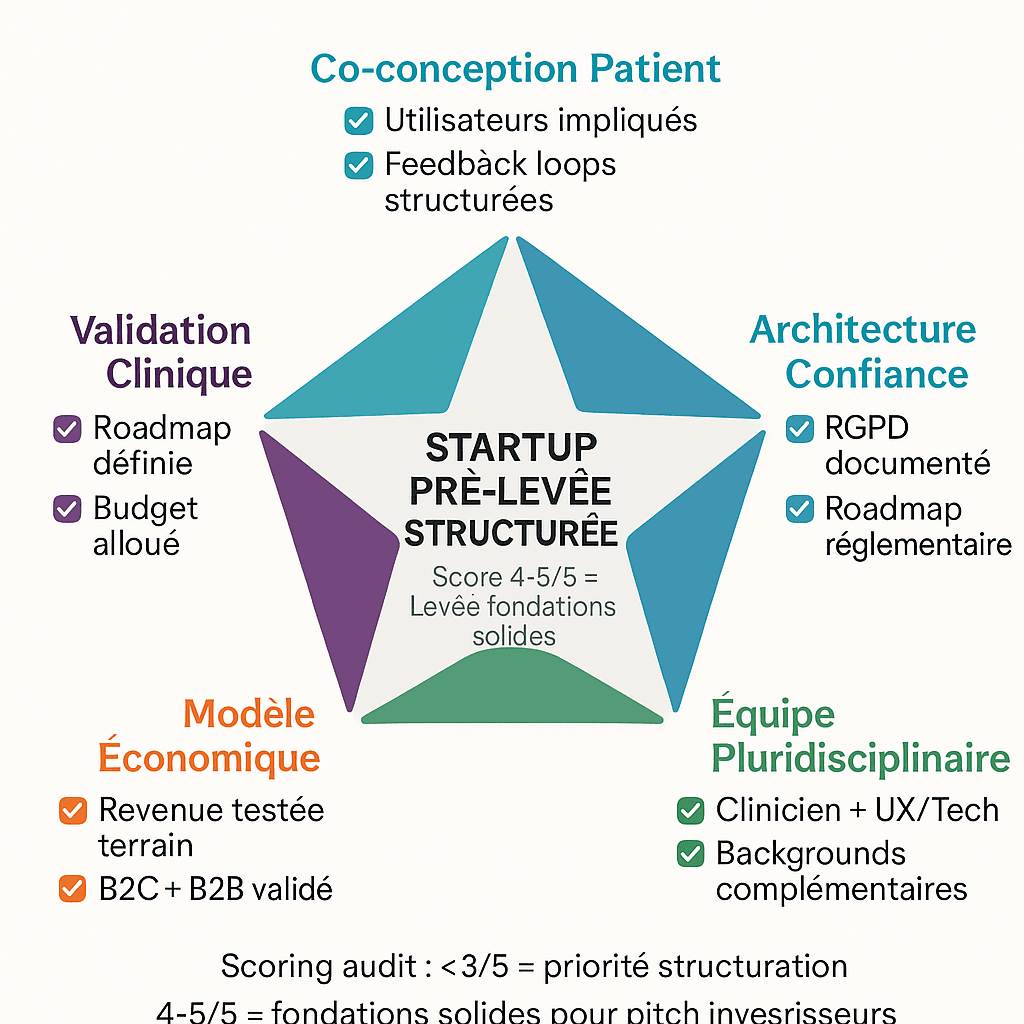

Framework pre-emergence audit – 5 dimensions

Before pitching, self-audit your women’s health startup on 5 dimensions. That’s exactly what our JuliaShift Pre-Levée Sprint systematically diagnoses.

Dimension 1: Validated patient co-design.

Key question: “Did you involve target users upstream of the MVP?”

✅ Approach: network co-creation, structured feedback loops, pre-MVP involved users.

❌ Counter-approach: internal silo construction, validation after launch.

Dimension 2: Mapped trust architecture (RGPD + compliance).

Key question: “Can you track patient data (collection, processing, safety)?”

✅ Approach: confidentiality documented, RGPD audit completed, regulatory roadmap defined.

❌ Counter-approach: “We’ll be compliant at the lift.”

Useful resource: HAS recommandations IA santé

Dimension 3: Multidisciplinary team.

Key question: “Who are the co-founders? Various disciplines?”

✅ Approach: merged team (clinician + UX/tech + ops), complementary backgrounds.

❌ Counter-approach: solo founder, homogeneous team.

Dimension 4: Validated business model.

Key question: “Do you have validated paying users OR structured B2B contracts?”

✅ Approach: field-tested revenue, dual model (B2C + B2B) or specialized.

❌ Counter-approach: “We’re going to monetize at the lift.”

Dimension 5: Clinical roadmap validation.

Key question: “Next step defined? Budget allocated? Precise timeline?”

✅ Approach: medical validation protocols defined, ANSM/HAS roadmap documented, budgets allocated.

❌ Counter-approach: “We’ll see with regulators.”

Scoring audit: <3/5 means not ready to raise (priority: structuring). 4-5/5 means solid foundations for pitch.

Conclusion

Structuring inclusivity is not CSR storytelling. It’s tangible investor risk reduction.

The Eva, Hélène, Emeline, Delphine and Iris cases demonstrate the pattern: founders who integrate inclusivity from day zero (patient co-design, trusted architecture, multidisciplinary team, tested business model, clinical validation roadmap) structure more solidly.

Investors don’t judge “feminist mission.” They judge operational signal: If you’ve structured inclusivity, you’ve structured product-market-fit, compliance, and adoption.

Universal lesson: whether you’re a women’s health, data or other startup, inclusivity from day zero is never an additional cost. It’s a strategic asset.

Are you bootstrapping a healthcare startup? Structuring before raising capital?

JuliaShift Pre-Levée Sprint: 5 days, 6,000 euros, full audit + structured lift roadmap.

🎯 Going further

Are you structuring a MedTech fundraiser?

Take action and secure your international expansion!

Your MedTech Series A/B can become a European leader. JuliaShift guides you with its Diagnosis – Execution – Control protocol to transform strategy, financing and clinical adoption into concrete results.

🔦 Discover the MedTech Blueprint → Strategic keys to your international deployments

🧩 Explore our Portfolio → Real projects, validated revenues, trained teams

🛎️ Book your 4D Diagnostic → Move to execution with a clear, prioritized plan

About the author

Nicolas Schneider is a strategic consultant in digital healthcare transformation and founder of JuliaShift. With 17 years’ experience at the Service de Santé des Armées and 8 years in digital transformation consulting, he assists MedTech startups and healthcare establishments in their financing strategy, structuring pharma partnerships and preparing for fund-raising.

Specialties: healthcare innovation financing, MedTech fund-raising structuring, pharma industrial partnerships, IA regulatory compliance.