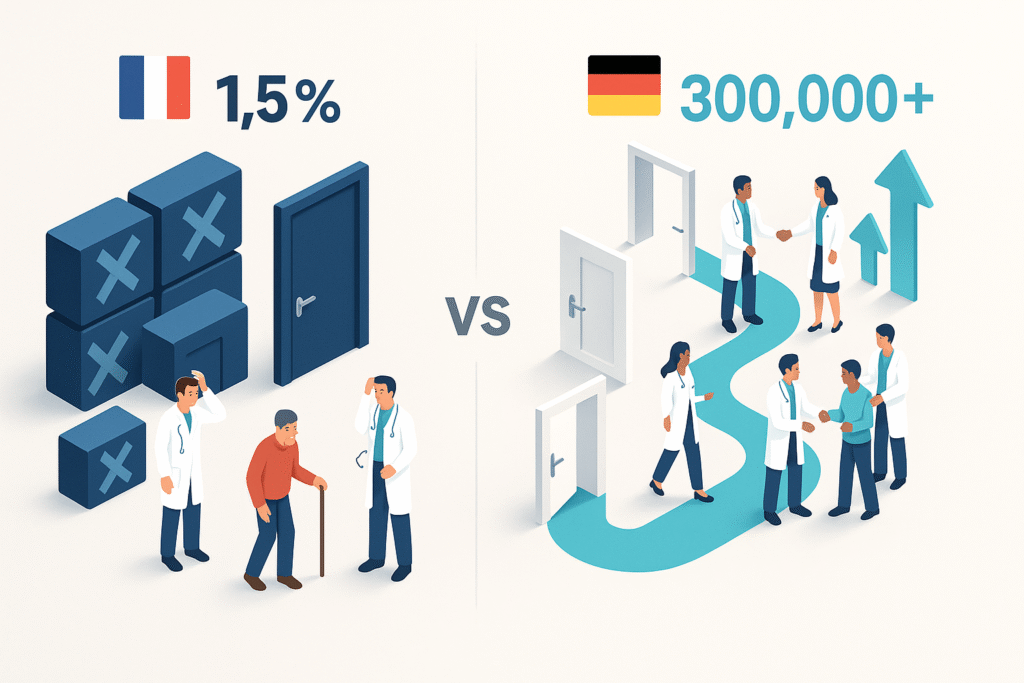

1.5% in France vs. 300,000 prescriptions in Germany. Why the gap is so stark

Between 60% and 80% of digital hospital projects fail. But remote surveillance? This is different. It’s not failure. It’s inequality.

In France, less than 1.5% of eligible patients will benefit from telemonitoring by the end of 2024. Two years after it became common law.

In Germany: 300,000 prescriptions. 56 applications reimbursed. 80 million budget by 2024. Sevenfold increase since 2021.

This difference is no mere detail. It’s a signal: organization, not technology, determines success.

France: paralyzing austerity

First, let’s look at the French context.

Remote monitoring covers only six pathologies: heart failure, renal failure, respiratory failure, diabetes, cardiac prostheses and oncology. This list comes from the ETAPES experiment (2018-2023).

The advantage: solid scientific basis. The problem: narrow market potential. Very narrow.

Next, let’s talk about compensation. Dual system :

- Operators: €43.45 to €91.67 per month

- Medical operators: €11 to €70 per month

Theoretically? Viable. Really? Access criteria are labyrinthine.

For “level 2 increased” heart failure (70€), you need precise combos: age, comorbidities, very specific clinical situations. This administrative granularity ensures rigor. But it also hinders professionals.

Air Liquide has left the French market. It’s revealing.

The SNITEM declared: “outdated evaluation criteria, designed for yesterday’s medicine.” Traditional methodologies don’t match digital devices. Period.

Germany: pragmatism that works

Germany, on the other hand, has opted for “fast-track”.

The program DiGA (Digital Health Applications) BfArM evaluates in 3 months maximum. Provisional registration? 12 months while you collect the real data.

Result: 73 million policyholders benefit from rapid access to innovations. Secure framework maintained.

The therapeutic spectrum has broadened considerably: 53% of DiGAs treat mental illnesses. 11% cover nervous disorders. 11% cover musculoskeletal pathologies. Compared to France? It’s three times wider.

The numbers are growing fast: 300,000 prescriptions exceeded by 2024. German universities even offer courses dedicated to DiGA.

But beware: only 30% of Germans know about DiGA. And 20% of prescriptions are never activated. So Germany has its challenges too. It’s just that these challenges don’t stand in the way of growth.

The real stumbling block: doctors, not patients

In France, as in Germany, the same problem arises: healthcare professionals are struggling.

In France, it’s worse. Managing data and processing alerts is extra work. And in a context of growing medical deserts, who will absorb it? Doctors ask, “Who will free up my time?”

Germany responds in part with training. Specialized. Large-scale. This is the key differentiator.

Evaluation: the French bottleneck

The French PECAN program is a case in point.

Since 2023: 10 applications submitted. 3 favorable opinions. All for remote surveillance.

This selectivity guarantees quality. But it also stifles innovation. So the Collectif Télésurveillance Médicale proposes an alternative: hybrid methodologies.

Combine real-life data, user feedback and population performance indicators. Recognize that digital devices have an organizational impact that goes beyond traditional biomedical criteria.

Why is this important? Because remote monitoring isn’t just an app. It’s a reorganization of the entire care flow.

How to unlock the French market

Firstly, to make things more flexible without compromising on rigor.

Germany shows that temporary care speeds up patient access. And you collect the real data at the same time. PECAN has started this. We need to expand.

Simplify eligibility criteria for premium packages, too. Less administrative granularity. More real access.

Secondly, to equip professionals.

Digital health delegates” already exist. Redirecting 30% of our efforts to remote monitoring would change everything. Continuing education. Medical school modules. Coaching in the field.

Strong signal: Franco-German agreement June 2025

France and Germany have signed a cooperation agreement on theevaluation of digital medical devices. Objective: harmonization. Mutual recognition. Accelerated market access.

Key deadline: revision of generic remote monitoring lines in **2026 by the CNEDiMTS.

It’s now or never. Integrate feedback. Adapt the framework. Take action.

France has the assets, but not the strategy

Recognized medical excellence. Cutting-edge technological innovation. High-performance social protection system. France has it all.

What’s missing: reconciling scientific rigor and operational pragmatism. Draw inspiration from Germany. Preserve French specificities.

Millions of chronic patients are waiting. It’s not just a technical issue. It’s a care organization issue.

For MedTech, it’s crystal clear: companies that navigate well in this evolving context win. Anticipate regulatory relaxations. Develop solutions tailored to professionals. Capitalize on potential.

To find out more

Are you developing a remote surveillance solution?

Let’s talk about your context. A quick 30-minute consultation to identify your real regulatory and commercial challenges.

🎯 Going further

Are you structuring a MedTech fundraiser?

Download our free strategic reports:

- BPI France 50-point compliance checklist

- Timeline 0-6 months pre-emergence

- 3 startup cases (seed → series A)

- Frameworks valorisation multiples Revenue

📥 Download your free reports → Blueprint MedTech

About the author

Nicolas Schneider is a strategic consultant in digital healthcare transformation and founder of JuliaShift. With 17 years’ experience at the Service de Santé des Armées and 8 years in digital transformation consulting, he assists MedTech startups and healthcare establishments in their financing strategy, structuring pharma partnerships and preparing for fund-raising.

Specialties: healthcare innovation financing, MedTech fund-raising structuring, pharma industrial partnerships, IA regulatory compliance.