Estonia built its centralized patient file in 1997. France will launch its Mon Espace Santé in 2023.

This gap of 26 years sums up the gap in digital health maturity in Europe. And it’s not a technological issue.

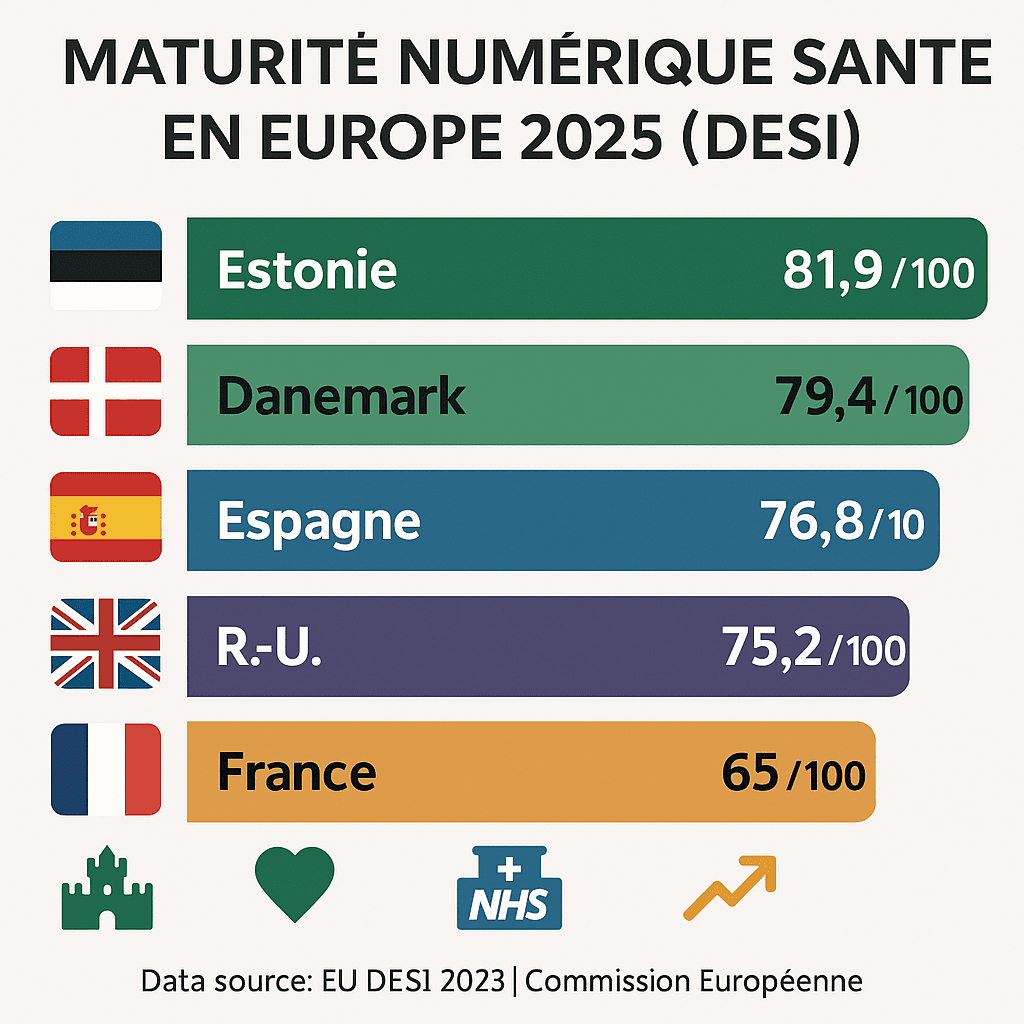

By 2025, the data are clear: Estonia has achieved a score of 81.9/100 on the European Commission’s digital maturity index (DESI 2023). France, despite its recent progress, remains fragmented, with misaligned regional initiatives and uneven adoption of interoperable standards.

The paradox? Europe has talent, a regulatory framework (RGPD, IA Act), and 144 billion euros of untapped economic potential. But fragmentation kills more than a lack of innovation.

At the end of this article, you’ll understand the 5 concrete levers that leading ecosystems have activated-and how to identify blockages in your context.

Europe’s digital maturity gap: facts and figures

Europe’s digital healthcare transformation is progressing, but remains profoundly uneven. The discrepancies observed are not academic details: they reflect major strategic differences.

The official ranking (DESI 2023, European Commission):

- Estonia: 81.9/100 (single patient record, native interoperability)

- Denmark: 79.4/100 (almost universal e-prescription, secure messaging)

- Spain: 76.8/100 (regional/national interoperable infrastructure)

- United Kingdom: 75.2/100 (NHS Digital = world reference)

- Germany: 73.1/100 (E-Health Act, increasing FHIR adoption)

France? Between 62-68/100 depending on criteria. Significant progress since My Espace Santé, but still fragmented: each region, each university hospital, each publisher negotiates its own connectors.

This fragmentation is not benign. It is costing Europe an estimated 144 billion euros in lost potential wealth over the next 5 years (European digital health market study, 2024).

Operational translation: an interoperable patient record project in France takes 3-4 years. In Estonia, it took 2 years in 1997. And it’s been running for 28 years without a redesign.

Why Estonia dominates: the systems approach

Estonia hasn’t built a solution. It has built an ecosystem of trust.

The three foundations of Estonian success:

A clear political decision in 1997

The Estonian government has laid down a non-negotiable rule: one citizen = one single, centralized patient file, accessible to authorized professionals.

Estonia imposes a no-debate approach: single dossier, no regional islands, mandatory standards.

This clarity is revolutionary. In France, meanwhile, 17 regional projects coexist without a coherent national vision.

Native interoperability through open standards

Estonia has made FHIR and HL7 mandatory standards, not optional. As a result, a new service provider can connect its system in 3-4 months. In France, it takes 1-2 years to negotiate.

Strong digital culture, supported by the State

Estonians digitized their government long before they digitized their health (e-signatures since 2000, online tax returns since 2001). Trust in digital technology is structural, not imported.

The concrete result? 70% of Estonian citizens agree to share their health data via the centralized system. In France, this trust has yet to be built up.

French blocking: fragmented but progressive

France is not failing. It is moving forward differently – more slowly, but with more inclusive foundations.

The three structural obstacles :

1. Multipolar governance (State + regions + institutions)

In France, decision-making takes place at several levels: the Ministry, regional ARS, hospital groups and facility directors. Each level has its own agenda.

Concrete example: Mon Espace Santé (2023) = a good government initiative. But university hospitals continue to invest in their parallel regional solutions, fearing dependence on the national system.

Impact: Each region redeploys custom connectors. Additional cost: €2-3M per region/year.

2. Fragmented healthcare IT market

France is home to 80+ medical software publishers, compared with 12-15 in Estonia. This fragmentation has two effects:

- Positive: Local innovation, diversity, competition.

- Negative: Zero incentive for interoperability. Each publisher wants to lock in its customers.

3. Costly transition to interoperability

Migrating 5000 French healthcare institutions from proprietary systems to FHIR requires :

- 3-5 years of implementation

- 500M-1.2B€ investment

- Redesigning medical workflows

- Massive training

That’s why France is moving forward step by step, not by regulatory coup d’état.

The 5 levers activated by leading ecosystems

National differences aside, the top-performing countries (Estonia, Denmark, Spain) share a common logic.

Lever 1: Clear, evolving, supportive regulatory framework

Estonia/Denmark: Digital health laws updated every 2-3 years. Publishers know what’s coming.

France: Monea 2023 creates the framework, but its implementation still depends on implementing decrees. Vagueness = slowness.

Pragmatic action: Demand that your facility align its transformation roadmap with the confirmed regulatory framework (mandatory FHIR by the end of 2026 in France = clear signal).

Lever 2: Shared national strategic vision

No philosophical debate. Europe’s leaders have chosen:

- A single standard (FHIR, not 3 options)

- A governance model (State finances infrastructure, private sector innovates on services)

- A performance timeline (year X = target Y)

France: Mon Espace Santé ≠ complete vision of interoperability. It’s a patient space. But no clear roadmap for hospital records or city-hospital coordination.

Lever 3: Trust-based patient data governance

Safety = non-negotiable. European leaders deploy :

- AES-256 encryption (Estonia)

- Blockchain for immutable auditing (experiments in Denmark)

- RGPD compliance audits every 6 months

- Real-time access log visible to the patient

Result: Patients accept data sharing because of institutional trust > absolute confidentiality.

In France, this trust is measured via Mon Espace Santé. Initial feedback (6 months after launch) shows growing adoption.

Lever 4: Adoption of open, interoperable standards

FHIR, HL7, IHE. No proprietary islands.

European leaders have opted for interoperability, which is cheaper in the long term than permanent custom integration.

Measurable example: A French university hospital switching to FHIR reduces its publisher integration costs by 40% after 18 months of implementation. Payback period = 2 years.

Lever 5: Structured public-private synergy

The State finances basic infrastructure. The private sector innovates services.

Denmark: Government deploys secure infrastructure. Startups build patient applications, monitoring, city-hospital coordination on it.

France: Emerging model. Mon Espace Santé = public infrastructure. But private partners (Doctolib, Kry, etc.) are slowly integrating.

Post-COVID operational changes: where transformation accelerates

Since 2020, three changes have been shaking up medical practices in Europe. They also explain why digital transformation is becoming critical.

Telemedicine boom

Volume: 10-fold increase over 3 years (2021-2024).

Consultations, chronic monitoring (diabetes, hypertension), minor emergencies. Telemedicine is no longer the exception; it’s standard.

Infrastructure impact: massive demand for connectors, authentication and network security. A facility without digital interoperability can’t scale telemedicine.

Real-time monitoring via integrated wearables

Connected watches, blood pressure monitors and glucose meters send continuous data to patient records.

France: Telemonitoring remains at 1.5% of patients. Germany: 300,000 prescriptions/year. Regulatory gap (no reimbursement in France for most cases).

But that’s the signal: healthcare data is becoming fluid, continuous, biometric. Fragmented systems cannot absorb this volume.

Hybrid classroom/telework courses become standard

Never again 100% face-to-face. The blended model (video consultation + face-to-face meeting when necessary) has become the norm.

Organizational consequence: medical workflows must adapt. This requires an aligned IT vision, redefined processes and training.

Only establishments with an interoperable digital infrastructure succeed in this transition.

The hidden potential: 144 billion euros of lost opportunities

Europe is home to some powerful digital health players:

- Doctolib (France): €83M in funding, leader in appointments + professional management

- Kry/Livi (Sweden/UK/France/Norway): Pan-European telemedicine

- ADAHEALTH (Germany): AI symptoms platform

- NHS Digital (UK): Europe’s largest healthcare infrastructure

But here’s the paradox: the absence of a unified digital marketplace limits their reach beyond national borders, in the face of American (Google Health, Amazon AWS for Healthcare) and Asian (Alibaba Health) giants.

Economic translation: 144 billion euros of potential wealth lost within 5 years.

This represents the market for pan-European e-health solutions that could emerge if regulatory/technical fragmentation were to disappear.

Towards European digital sovereignty in healthcare

Faced with the challenges of cybersecurity, sovereignty and ethics, Europe needs to speed up three major initiatives:

1. Continental industrial champions

Not just startups, but European scale-ups capable of competing with AWS, Google Cloud and Microsoft Azure for healthcare cloud solutions.

Positive signs: initiatives such as OVHcloud Health and Scaleway Healthcare are emerging.

2. Common framework for responsible innovation

IA Act + RGPD + ethical framework IA = minimum standard for any new player.

Europe is building forward-looking, not reactive, regulation.

3. European Health Data Space (EHDS)

Flagship initiative launched in 2024. Objective: to create a shared health data base, in line with European values (medical confidentiality, fairness, transparency).

EHDS is at the heart of the European strategy for 2025-2030.

Your context: diagnosis and next steps

If you are managing a digital health transformation (university hospital, hospital group, e-health startup), three key questions :

- Is your facility aligned with a clear vision? (Estonia = yes. Fragmented France = depends on your region)

- Have you initiated FHIR migration? (Maturity criterion #1)

- Have you defined patient data governance based on trust? (Step 2)

If you hesitated, you now know where the levers are.

To find out more

- European Commission – DESI 2023 Index

- HL7 FHIR – Healthcare interoperability standard

- European Health Data Space (EHDS)

- My Health Space – Government France

🎯 Are you working on digital health transformation?

Let’s talk about your context. Whether we’re structuring European strategy, assessing product/regulation fit, or piloting FHIR implementation: we diagnose blind spots and lay the foundations for an aligned transformation.

Strategy audit + operational recommendations: 30 minutes free of charge.

🎯 Going further

Are you structuring a MedTech fundraiser?

Download our free strategic reports:

- BPI France 50-point compliance checklist

- Timeline 0-6 months pre-emergence

- 3 startup cases (seed → series A)

- Frameworks valorisation multiples Revenue

📥 Download your free reports → Blueprint MedTec

About the author

Nicolas Schneider is a strategic consultant in digital healthcare transformation and founder of JuliaShift. With 17 years’ experience at the Service de Santé des Armées and 8 years in digital transformation consulting, he assists MedTech startups and healthcare establishments in their financing strategy, structuring pharma partnerships and preparing for fund-raising.

Specialties: healthcare innovation financing, MedTech fund-raising structuring, pharma industrial partnerships, IA regulatory compliance.